is preschool tax deductible canada

Both children are enrolled in a preschool that costs 7000 per student. Tuition for preschool and K-12 is a personal expense and cannot be deducted.

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Preschool expenses like other child-care expenses you pay so that you.

. An eligible child is one of the following. Child care expenses 101. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction.

With this in mind is 2021 preschool tuition tax deductible. Find out what expenses are eligible for this deduction who can make a claim and how to calculate and claim it. Tax Credits for the Tuition Expenses of Your Kids.

Heres what financial and tax experts want parents of preschoolers to know. Is Preschool Tax Deductible Canada. Preschool and day care are not tax.

Child care expenses can only be claimed for an eligible child. Line 21400 was line 214 before tax year 2019. May 31 2019 752 PM.

A qualifying child is under the age of 13. The Canada Revenue Agency CRA provides parents with child care deductions for income tax purposes. Line 21400 was line 214 before tax year 2019.

Why sign in to the Community. Assuming you meet these qualifications during the 2021 tax year you can claim up to 50 of the first 8000 that you spend on preschool tuition and other care-related expenses. You can claim child care expenses that were incurred for services provided in 2021.

The Canada Revenue Agency CRA provides parents with child care deductions for income tax purposes. The adult filer discovers that they are eligible for the equivalent of 35 percent of their qualifying expenses. Have A Qualify Child.

The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. However you may qualify for the child and dependent care credit if you sent your. Tuition for kindergarten and up is not an eligible expense.

5000 per child for children aged 7 to 16 years. Child Care fees at Kendellhurst Academy are deductible as follows. Expenses under kindergarten preschool tuition day care etc are always eligible even if the program is educational.

Your or your spouses or. What Expenses Does Head of Household Pay for Dependents. Daycare summer camp nurseries and nanny services are all deductible expenses for parents but the tax deduction must be claimed by the parent in the.

Line 21400 Child care expenses. Child care expenses are amounts that you or another person paid to have someone look after an eligible child so that you or the other. A child must be determined as your qualifying child in order to receive the child and dependent care credit.

You can claim child care. Lines 21999 and 22000 Support payments. Are preschool fees tax deductible in Canada.

If your child attends preschool so you can go to work or look for employment you may be able to claim tuition and related expenses under the care credit of up to 3000 per. These include payments made to any of the following. A credit called the Child and Dependent Care.

Canadian taxpayers can claim up to 8000 per child for children under the age of 7 years at the end of the year. Line 21400 was line 214 before tax year 2019. Sign in to the Community or Sign in to TurboTax and start working on your taxes.

Early Childhood Education And Care News Research And Analysis The Conversation Page 1

San Juan Bautista Preschool Announces It Will Close Local News Lancasteronline Com

Can I Deduct Preschool Tuition

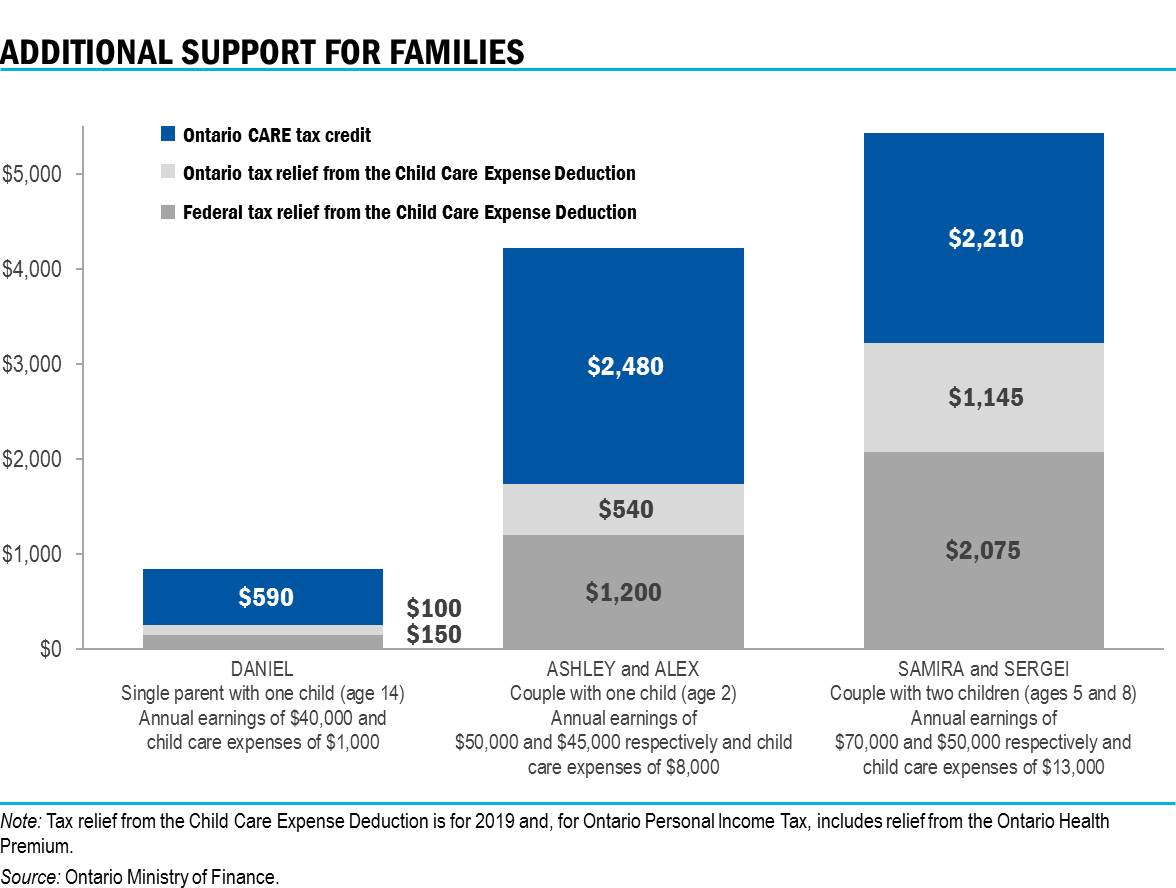

2019 Ontario Budget Giving Parents Flexible And Affordable Child Care Choices

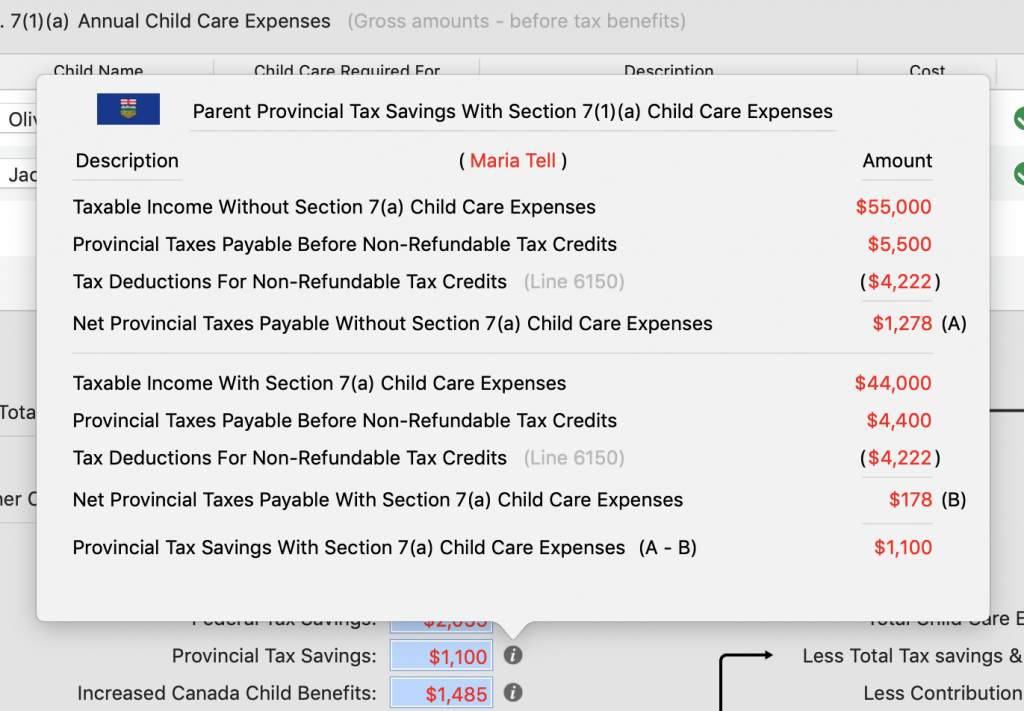

Calculating The Net Costs Of Child Care Expenses Using Iguideline S Powerful Features

Better Daycare For 7 Day One Province S Solution For Canada The Globe And Mail

How West Virginia Established Universal Pre K The New York Times

Pre K Admissions Assumption St Bridget School

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Claiming Child Care Expenses In Canada

What S In Democrats 1 75 Trillion Spending Bill The Heritage Foundation

Pdf Child Care Fee Subsidies In Canada

What S In Biden S Plan Free Preschool National Paid Leave And More The New York Times

Amazon Com Costzon Kids Table And 2 Chair Set For Indoor Outdoor Use Steel Table And Stackable Chairs Preschool Bedroom Playroom Home Furniture For Toddlers Boys Girls Mint Green Table Chairs Home

Pre K Education Gets Seat In Center Politico

Home Daycare Tax Deductions For Child Care Providers Where Imagination Grows

Your Step By Step Guide To Opening A Daycare Rasmussen University

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips